The realities and paperwork of being a self-employed trainer/therapist.

I’ve helped a couple of guys set up as self employed trainers over the last year, both as technical coaches and personal trainers. There’s always going to be local variations in tax law etc. but I thought I’d share with you some of the ways I keep on top of business and what I recommended to them. Job uncertainty and low wages in sport means that there’s a lot of talk of ‘side-hustle’ or second income streams. Having a YouTube channel or a couple of online training clients might sound like a good idea, but as well as the actual work-work there’s a lot of office-work which goes into keeping everything running legally.

I’m not going to talk about advertising, social media strategies, client records etc. in this article just the realities of day-to-day office work which have to be done wether this is your main income or a couple of TRX sessions in the local gym on a Sunday morning.

I have run a British Ltd. company in the past (for ten years) but now I’m self-employed in Germany. Most of this advice will apply to being self-employed. There are a lot of similarities between being a company director and self-employed, but some subtle differences and some big legal differences, which leads me on to my first point:

Get an Accountant.

The only way to deal with local bureaucracy regarding tax laws, registrations, licenses etc. is to get help from a professional. A good accountant will save you money int he long term, and a lot of hassle when the tax office starts asking questions so I 100% recommend that you use one.

There are two ways that you can deal with an accountant and how you do your bookkeeping - you can spend time, or you can spend money. You can just throw all of your invoices and receipts into a box and then give the box at the end of the month/year to the accountant to sort out. They will do this, but they won’t like you and at €xxx an hour it’s going to cost you €xxxxxxx.

The second way is to keep your books in order. This takes a little time, but at least you know where you stand and will save you accountancy fees. This is the route I’ve chosen, blanking off time in my calendar at the end of each month to write invoices, chase unpaid bills, file tax returns etc. For a long time I did a lot of this manually, using a spreadsheet and word processing software. This is a perfectly valid solution, but I’ve now moved on to using specialist systems, again they cost money but make my life a lot easier.

Another point here is to get a business bank account - if you don’t have to filter out all of the weekly shopping etc. etc. then it makes your life lot simpler.

The Manual Method.

The cheapest way of bookkeeping is with a spreadsheet. As I said, I did this for a long time, it takes a little effort, but it works. The spreadsheet can be as simple or as complicated as you want it to be, as long as it holds all of the basic information - date of issue and payment for each invoice/receipt, amount, name and invoice numbers. If you have to pay MwSt/Sales Tax/VAT then this also needs to be recorded.

A really basic spreadsheet.

Everything goes into this spreadsheet - EVERYTHING!

My spreadsheet also used formulas to automatically highlight unpaid invoices and give an estimate of profit/loss per month and year, so that I had a good overview of the business. It was also more complicated so that it complied with the principles of double-bookkeeping. How simple or complicated you want to have it depends on local laws and the time v cost equation.

The actual physical invoices and receipts went into a folder in the same order as they were recorded in the spreadsheet so that my accountant didn’t have to go looking for anything, again saving me money on hourly fees.

Invoices were written manually using a pre-set template, with the invoice number carefully checked against what has come before on the spreadsheet (a gap in or repeated invoice numbers will look very suspicious to the tax authorities) and all of the details were entered into the spreadsheet.

The High Tech Solution.

Once I went over the threshold for paying MwSt/Sales Tax/VAT I decided to switch to accounting software as it greatly simplified calculations, this is especially important if you’re in a country where the tax reporting has to be done electronically. It’s the time v cost equation again - software costs money but saves you time that you can the spend training/treating people and making money.

My chosen software is DEBITOOR. I chose this because after the free trial I was happy with how it worked, it can write invoices in multiple currencies and languages, integrates well with my other systems (more on this later) and is capable of filing the monthly tax returns I have to file electronically to my local tax office.

(If you try it out and like it then you can get a 25% discount on your first year using THIS LINK.)

It also allows my accountant to access the info, so even though I do still keep a folder with a physical copy of everything in it she can quickly look into my accounts should I have any questions. This was very valuable recently when I had to show my earnings to my health insurer as they wanted to recalculate my premiums. By logging into my account and looking at the reports she was able to supply the required forms in no time. If she’d have had to go through a folder and manually calculate everything it would have taken weeks.

Debitoor will sync with banks and payment services such as PayPal to automatically reconcile payments, again saving me a lot of time. There will always be small problems, such a client paying the wrong amount, but 95% of the reconciliation is performed just be clicking ‘refresh’ on each of the accounts.

Another benefit of Debitoor is its ability to handle ‘other income’. This covers payments for which I don’t write a full invoice, such as small sales, individual sessions or when I teach for an organisation and have to fill in their claim/reimbursement forms.

There are of course other bookkeeping solutions available including FRESHBOOKS, LEXOFFICE, QUICKBOOKS, and XERO. You’ll have to try them out to see if they are available in your currency and language and if they play nicely with your local tax office.

Appointments.

The majority of my work is through a couple of big clients (gyms, rehab centres, sports teams etc.) and so my scheduling relatively simple - on this morning I’ll be in this gym - which I record on iCal calendars synced between my iPad, phone and laptop. I do however have a couple of private clients and so appointment booking systems are something I’ve just started looking at. The obvious solution is for the clients to call to make an appointment, but I run my website on SQUARESPACE and they have an appointment system called ACUITY SCHEDULING which I’ve just started playing with. I think at the moment the price is a little too high for my needs, but if you run PT sessions and want your clients to be able to book in without ringing you (and taking you away from the client you’re training) or can’t answer the phone because you’re performing massages then it could be good. I also like the fact you can send individualised appointment possibilities to somebody. I have used this to schedule a phone meeting with somebody, I entered the times I’ll be in the office rather than the noisy gym, sent him a link, then he could click on the option that was best for him (best of all this feature is available on the free tier).

If you do decide to try Acuity I again have an affiliate link for you - LINK.

If anybody else has recommendations for low cost appointment scheduling solutions then please share them in the comments below.

Update: I did decide to go with Acuity in the end as I have reduced the number of classes I teach and have taken on more individual clients. It has allowed me to embed direct booking links on my website had has been useful when clients reschedule or cancel, as they can do this using links in the confirmation e-mails.

Time Tracking.

This is a point that I haven’t fully automated yet, how do I know how much to invoice my clients?

I have a couple of clients for whom I do regular work - rehab sessions, personal training, sports massage etc. At the end of the day I write what I’ve done into a spreadsheet. This isn’t fancy or complicated, just ‘date’ ‘massage’ ‘2’. This spreadsheet is in Excel, saved in Dropbox for safety and so that I can access it on the road. All day everyday I carry an iPad and it’s only when I’m at the office at the end of the month that I sit in front of the big computer, otherwise I can access everything on the road. This is important to me as I don’t have a fixed work location.

At the end of the month, when I do sit in the office, then I generate a pivot table with all of the sessions that I’ve performed for the client. This puts together all of the info I need to write the invoice in Debitoor (how many training sessions, how many massages etc.) and once the invoice is generated then I’ll attach the pivot table so that the client can check on their side the appointments against what I’ve charged them.

Time tracking spreadsheet.

The pivot table output.

Taking Payments.

Invoices sent out electronically by Debitoor have a link to PayPal where customers can pay you (get a PayPal account, it’s useful for getting paid by young sports people, especially those in other countries). If the client choses to pay by bank transfer then this is covered by Debitoor’s automatic reconciliation. Equally if they pay in cash then just record it in Debitoor, they have a mobile app so it’s quick and easy to do. But what if they want to pay by credit or debit card? Remotely it’s covered by the PayPal link mentioned above but face-to-face with a client you need a card reader.

Debitoor is owned by the payment processor SUMUP, this allows for easy integration and you can get a card reader from them to take payments. (Again I have a DISCOUNT CODE for SumUp, if you’re interested. Neither iZettle or SumUp charge a monthly fee, but take a percentage of card transactions, like PayPal.)

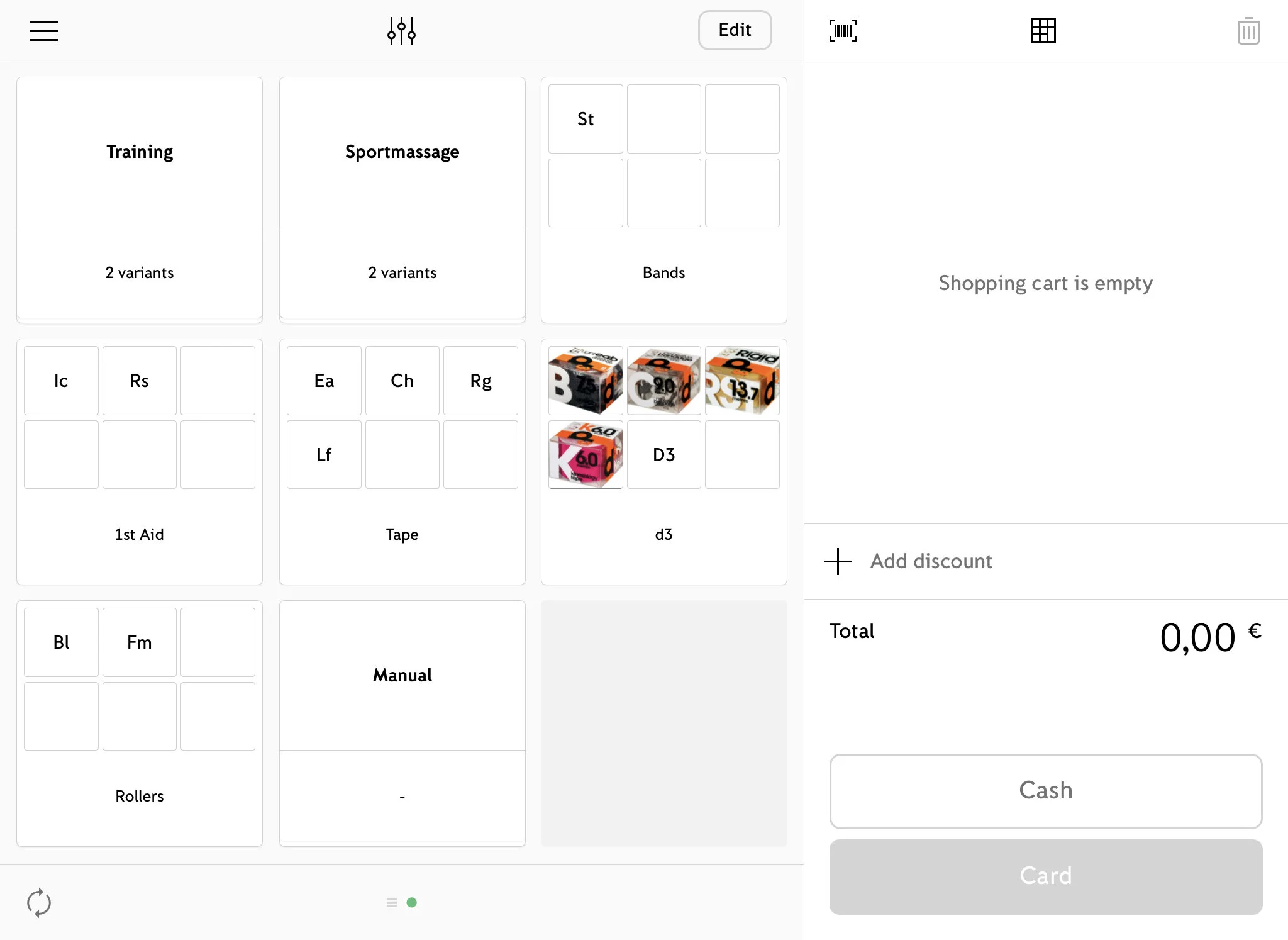

The card reader (and associated app) can also be used as a Point of Sale system for dealing with small payments that don’t require an invoice. Personally I use iZETTLE as a Point of Sale system - I prefer the user interface and I already had a card reader from before I switched to Debitoor, but they’re small and easy to carry, so having to carry two is no hardship. You can obviously save yourself some money buying the card readers and space in your rucksack by just using the one system.

My two card readers which live happily in my rucksack in a case for external hard disks I picked up off Amazon (LINK).

I use iZettle for individual payments such a one-off massage or training session, selling a roll of tape or a foam roller etc. You can see the dashboard below, I haven’t photographed all of the items, so it’s not as pretty as it could/should be, but you get the idea.

Once again iZettle integrates with Debitoor so that all of the transactions are automatically recorded. The only exception to this are card processing fees which show up in the transaction list, but aren’t automatically added as an expense. This isn’t a huge deal for me as I don’t actually take that many card payments, but it could be something to keep in mind when you’re setting up.

Another benefit of iZettle is that it is GoBD compliant. These are the laws in Germany (where I’m based) which cover the operation of electronic cash registers, so it was obviously important for me to to choose a system which is legal in my country. There is no fee for dealing with cash through iZettle.

Receipts are either e-mailed to the client, sent as link via SMA or if you have access to an AirPrint printer in the clinic/gym then can be printed out directly. You can buy receipt printers, but the ability to use a normal printer is another factor with helped me chose iZettle over SumUp for POS.

Update: Germany has introduced a law stating that a receipt has to be issued for every transaction. I don’t have an AirPrint printer in every gym and some of the older patients aren’t super tech savvy, so I’ve bought a small, portable, battery powered receipt printer which links to iZettle on my iPad. So far I’m very happy with it. You can get them from Amazon HERE.

These POS systems and card readers require internet access to process the transactions. You can install the apps on your phone or use an iPad and tether it to your phone, but for simplicity’s sake I’ve gone for an iPad with built-in cellular access. This obviously isn’t a big deal if you work in a gym/clinic where wifi is available. My iPad is my main device when I’m out of the office, used for all of the transactions, scheduling etc. mentioned in this article as well as for video and technique/velocity analysis with clients so I have fully justified the extra expense of the cellular model and data contract.

EXPENSES.

Once again you need to take professional advice as to what is allowed in your country, but as a general rule all business expenses should be paid from your business account (and then recorded in your accounting system). As soon as you start mixing things up, buying your lunch and a printer cartridge in the same transaction on your personal card then your bookkeeping becomes messy.

There are obvious business expenses - insurance, web site, the above accounting software, card readers and transaction fees, rent etc. etc. but there are also things which aren’t so clear. For example if you’re self employed in Germany you can claim €0.30 per km on business travel as long as you only use your car for under a certain % of business versus personal travel. If it’s mainly used for business travel then you can put all of the car expenses through the business books, but you personally get taxed 1% of the list price of the car as it’s seen as a benefit.

When travelling for work you can also pay yourself a certain amount per day as a daily allowance to cover food. This amount varies depending on how long you are away for and in which country you’re working. So for example when I was the minder for a cyclist at a competition in Germany we were away from home for 12 hours, so I was able to pay myself, tax free, €12. When I was teaching in Switzerland and travelled Friday evening, taught Saturday and returned home Sunday then I could pay myself the €12 for Friday (at the German rate, it goes on where you were at midnight), €62 for Saturday (24 hours in Switzerland) and €41 for Sunday (more than 8 hours, but less than 24, starting in Switzerland). As I said, it’s not super easy, so make sure you’ve got the up-to-date information/rates that you need to work this out.

€12 + 62 + 41 = €115 which is a respectable amount to be able to pull out of the business account tax free, so keeping accurate time sheets is important. These could easily be another page on the spreadsheet you’re using to track your client work, but I’ve chosen to use EXPENSIFY to record my travel and daily allowances (I like a good tech solution). It’s a free service with apps for the phone (with GPS tracking to record distance driven) and tablet as well as an online portal, so there’s no excuse for not recording everything. At the end of the month, during my accounting session I’ll print the monthly report, pay myself what is owed and then record it all in Debitoor.

Getting money out of the business.

You will have to pay tax on your profits. This is why you try to put as much as (legally) possible through the business books, to reduce profit. This is why you need professional advice.

Every country’s tax rates will vary depending on how much profit you make, so again, get advice. I will generally set aside 30% of my profit to cover future tax bills. I have a separate savings account and will regularly look at the profit/loss reports in Debitoor. 1/3 of the profit should be in the savings account. I’m a little ad-hoc on this, I know others who will automatically transfer 30% of profit during the bookkeeping session at the end of each month. The actual tax bill may be slightly higher or lower than this amount, but it gives you a decent amount of security to know that there’s money there.

How you deal with the rest is up to you. There has to be money left in the business account to cover bills and you’re going to need some to live, so a common split is 50/50. Honestly there are going to be months when you make a loss, when clients are slow to pay, when you’re away at a tournament and only get paid 30 days after return. Then the next month all of the money will come in at once.

If you do any work for a sports club or federation it will take a very long time to get paid.

This is why I think it’s important to have a decent overview of your finances, so you can plan for and accommodate the fluctuations. Being an employee with a stable wage is very different.

An example of how money flows through a business. I know there’s 10% missing on the last split, that’s flexibility.

Now obviously these percentages are only guides, it may be Christmas and you need a little more money at home, you may need to buy flights, hotel and tickets for a conference and so you need some flexibility. You may dip into savings if you have a big expense (hello Apple store!), but as long as you remember that you need to keep enough there to cover your next tax bill. (Of course a big expense will lower the tax bill, but that’s why you need to keep an overview of these things. MwSt/Sales Tax/VAT is calculated on turnover and not profit, so be careful, these bills can bite.)

Conclusion.

I hope that you can see that even a little bit of extra income brings a lot of extra thought in how you deal with it. If you decide to make this second income your main job then you have to get set up well, so that you don’t spend 75% of your time on the paperwork and only 25% with clients.

I hope that this post has been informative and useful, feel free to ask any questions you have, I will direct them to somebody who actually has a clue what they’re doing.

I hope that you talk to an accountant.

If you have enjoyed this blog or have found it useful then please consider making a donation towards the running costs. Contributions can be made via credit card or PayPal using the buttons below: